The Lowdown

With more than 100 million customers and 14,000 physical branches, Santander is one of the largest banks in the world. With that prominent status, the company maintains its post as a global banking leader by exploring and creating new competitive advantages. When Santander contacted hedgehog lab, they were interested in developing innovative strategies to benefit their customers.

The Problem

During our conversations with the Santander team, one of the biggest opportunities we identified was the stagnation in online banking. Mobile banking apps reduce the need to visit a physical branch, but certain services remain difficult to provide online, especially when it comes to products like mortgages and business loans.

The Solution

The future of banking, we determined, was to continue increasing online banking capabilities by bringing the entire banking experience into the home. Instead of simply managing accounts through a mobile app, customers should be able to visit a physical bank location and interact with representatives on their mobile screens from the comfort of their favourite easy chair.

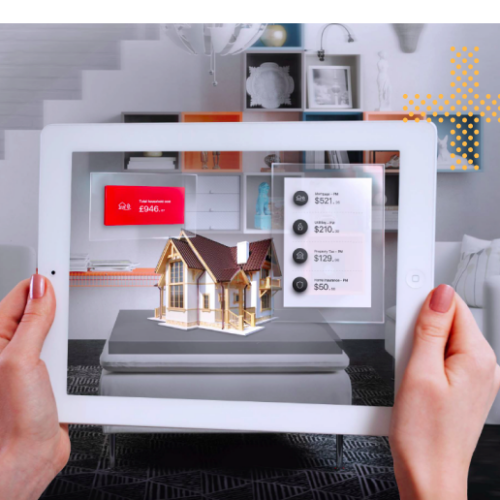

To bring that personal connection into the mobile experience, we proposed an augmented reality (AR) app to immerse the user in the physical world of a typical Santander branch. The app allows the user to talk to a bank teller or manager exactly as they would in a real Santander bank—but from the comfort of their own home.

Thanks to the ability to communicate face-to-face, customers can access Santander’s full suite of products, including loans, mortgages, and retirement products.

Requirements

We uncovered additional opportunities by surveying current Santander customers. We learned:

- Personalization is a top priority

- The majority of customers bank digitally

- Mobile apps outperform desktop online banking

- With this data in hand, we set out to recreate the online banking experience and increase the number of services available online.

The Product

Following through on the app could potentially create two major benefits for Santander:

- Overhead reductions. With 14,000 branches to maintain around the world, Santander has significant annual costs related to real estate alone. Leaning into the app’s capabilities to bring the branch to the consumer may allow Santander to reduce the number of physical locations it holds throughout the world.

- Improved customer experience. Research shows that consumers want a banking experience without the brick-and-mortar bank. With Santander’s new AR capabilities, their customers can receive Santander’s full range of services without visiting a physical branch.

By continuing to provide additional customer-driven technologies, Santander can elevate its presence in the banking world and capture a greater market share.